Governance

Corporate Governance

We consider the steady improvement of our corporate value over the long-term as one of our most important management issues. In order to achieve this, we must realize long-term, stable growth through the provision of products that are satisfactory to customers and establish a good relationship with each stakeholder, including our shareholders, investors, customers, suppliers, local communities, and employees. We have shared and acted on this approach, which is based on our Management Principles, in the Aisan Group Action Agenda and VISION2030.

Moreover, we will strive to maintain and improve management efficiency, fairness, and transparency in accordance with the Corporate Governance Code established by the Tokyo Stock Exchange.

Corporate Governance Structure

This image can be enlarged by pinching out

In addition to the legal functions of the General Meeting of Shareholders, Board of Directors meetings, Audit & Supervisory Board meetings, and the accounting auditor, we have appointed five outside directors and three outside Audit & Supervisory Board members with the aim of supervising and auditing the Board of Directors from an expert, impartial and fair standpoint to ensure management transparency and prompt decision-making. Personnel matters concerning directors are discussed preliminarily by the Officer Appointment and Remuneration Committee, a majority of whose members are outside directors, to ensure fairness and transparency by obtaining appropriate involvement and advice.

Candidates for outside director are appointed based on the independence criteria set forth by the Companies Act and the Tokyo Stock Exchange, with emphasis on the possession of advanced knowledge and wealth of experience necessary to provide candid and constructive advice and supervision of our management.

Each director and executive officer divides their work vertically and horizontally between departments, businesses and foundations, and strives for prompt and efficient business execution through cooperation, while striving for appropriate business execution through mutual checks.

Results of Board of Directors Meetings in FY2024

| Meetings held | 13 times |

|---|---|

| Attendance | Directors: 99%, Audit & Supervisory Board members: 98% |

Composition

| From June 2024 | From June 2025 | |

|---|---|---|

| Number of directors | 9 | 10 |

|

Of which, outside directors

|

3 | 5 |

|

Of which, female directors

|

2 | 3 |

|

Of which, independent directors

|

3 | 5 |

| Number of Audit & Supervisory Board members | 5 | 5 |

|

Of which, outside Audit & Supervisory Board members

|

3 | 3 |

|

Of which, female Audit & Supervisory Board members

|

0 | 0 |

|

Of which, independent directors

|

2 | 2 |

| Number of senior executive officers | 13*1 | 6*2 |

|

Of which, female senior executive officers

|

0 | 0 |

- The title of the position in 2024 was Executive Officer. Six concurrently serving as director

- Four concurrently serving as director

Evaluating the Effectiveness of the Board of Directors

We conduct an annual effectiveness evaluation of the Board of Directors to verify whether the Board of Directors is functioning appropriately and to work to improve its functionalities. The results of the effectiveness evaluation are shared at the Board of Directors as a reporting item, and the future structure and operation of the Board of Directors are discussed in order to improve the effectiveness of the Board of Directors and strengthen governance. The effectiveness evaluation of the Board of Directors for fiscal 2024 was conducted in May 2025 using both score evaluation and the comment section. The evaluation results indicated generally positive evaluations and comments on each item, judged that the effectiveness of the Board of Directors has been ensured. In addition, in the discussions at the Board of Directors, there was an opinion that it is necessary to strengthen information sharing on risks and to further deepen risk analysis. In response to this, we will strive to improve the effectiveness of the Board of Directors by thorough sharing information for deeper discussions and by reporting on activities related to risks.

| Evaluator |

|

|---|---|

| Evaluation Method |

|

| Main Evaluation Items |

|

| Initiatives of FY2024 |

|

| Main Challenges and Measures |

|

Executive Compensation

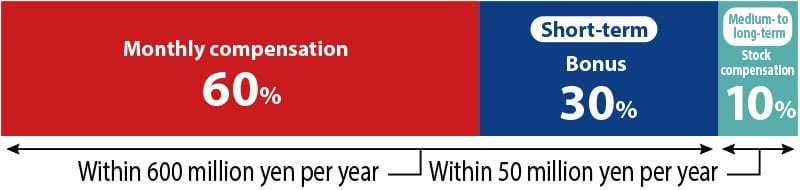

Compensation for directors is first proposed in draft form to the Officer Appointment and Remuneration Committee* based on each director’s position and responsibility and with consideration for business performance and management environment. The aim is to encourage directors to continuously improve business performance over the medium to long term and contribute to the enhanced corporate value of the Group. Compensation is determined by the Board of Directors. The compensation structure consists of monthly compensation, bonuses (shortterm incentive), and restricted-share compensation (medium- to long-term incentive), at an approximate percentage of 60%, 30%, and 10%, respectively. Monthly compensation is set at an appropriate level, taking into consideration the business environment, among other factors, and reviewed on a regular basis according to the position of the director. Bonuses are linked to performance and determined using the applicable fiscal year’s consolidated operating profit as a metric while also adjusted based on individual appraisals. As for stock compensation, the restricted-share compensation system is in effect, with the aim of further improving directors’ shared value with shareholders and continued enhancement of our corporate value. At the General Meeting of Shareholders held on June 13, 2025, it was decided that the sum of a director’s monthly compensation and bonus is limited to a maximum of 600 million yen per year (of which a maximum of 100 million yen per year for outside directors). The total compensation amount for restricted shares awarded to directors, except outside directors, is limited to a maximum of 50 million yen per year.

- We have established the Officer Appointment and Remuneration Committee, which is equivalent to a Nomination Committee and Compensation Committee. The committee consists of two internal directors and five outside directors, and is chaired by an internal director. The President makes decisions based on reports from the Officer Appointment and Remuneration Committee, and in turn, puts it on the agenda of the General Meeting of Shareholders and the Board of Directors.

Compensation Structure for Directors

Off-site meetings

We provide opportunities for directors and officers to exchange candid opinions with each other outside of Board of Directors meetings and other regularly scheduled meetings.

The participants spend two days and one night outside the company, exchanging views on the current environment of the automotive industry, including the Company, human resource development and diversity initiatives, as well as governance. It is an opportunity to further communication beyond work-related conversations away from the workplace, and to take a step forward in thinking about ideas related to future company growth.